I just published my trade plan for tomorrow, May 9, 2024. In that post, I spoke about the lack of trade location to initiate a short trade today according to our directional level. In this post, I like to share with you on something that I am experimenting with the directional level using credit spread options.

Today, while I was waiting for a short setup to show up for me to initiate a short position, I have decided to sell some call vertical above our watch level for some credits.

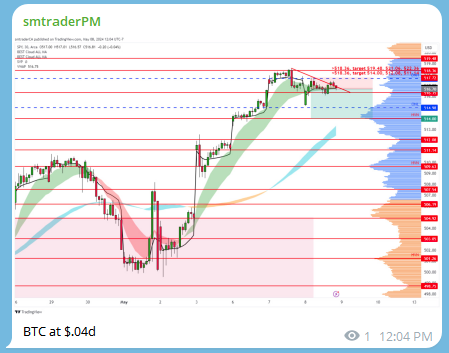

Here’s what I’ve posted on my private telegram to document and time stamp my trades and observations.

On this post, I’ve stated I am selling some SPY 0DTE 518/519 call spread for a credit of $0.20 per contract. My stop loss will be the short strike plus 2 times the premium collected (518 + $0.40 = 518.40). Therefore, I will close this credit call vertical with 1x of premium collected as a loss. Because if the price is back above the directional level, I am on the wrong side of the trade.

My profit target is 80% of the premium collected, which will be $0.16. Therefore, I will close the position by buying back the call vertical at $0.04. Here is the post when I BTC (buy to close) to close the position.

You might say this is crazy, it’s less than 1 to 1 risk to reward ratio. Why would I take such a trade. Well, the 518 call has a delta around 20 and that implies the probability for it to expire OTM is around 80%. If it expires OTM, that mean one get to keep 100% of the premium collected. With a win rate of 80%, you will have a positive expectancy with approximate 1 to 1 RR.

Here’s a sample expectancy calculation using this trade as an example:

Expectancy = win rate % * average win amount – lose rate % * average loss amount

Expectancy = 0.80 * 0.8R – 0.20 * 1R

Expectancy = 0.64R – 0.20R

Expectancy = 0.44R

As you can see, the expectancy is calculated to be $0.44 for every dollar risked. This scheme requires one to limit the loss to be 1X the premium collected and size the number of contracts according to the risk amount per trade.

From the two charts posted on my telegram, you could see the price level when this trade was closed was not that much lower than when I initiated the trade. This is due to the time decay, theta. In matter of fact, if one did hold this position to expiration, one would get to keep 100% of the premium collected because this call vertical expired worthless. I do not like to hold the trade into expiration even though the odds are in favor of it expiring worthless. One will never know when a fat finger pushes a wrong key, or J Powell say something that set the SPY off and cause the price to move against the profitable position. Worst yet is to turn a profitable trade into a huge loss trade. To me, it is not worth the risk for the few extra points, that’s why I like to lock it at 80% premium collected. Of course there is a time element to this as well. I will also close the position as time is getting near the close. I don’t want to see that last minute huge OpEx price move to take back all the unrealized profits.

This is something I am experimenting as another way to use the directional level in my trade plan. I will do more of these trades when the opportunity arises and see how it performs. This is not a multiple bagger trading strategy. So it is not for everyone. I am experimenting this with 0DTE only. In the long run, this could turn out to be an unprofitable trading strategy due to duration being too short and sporadic intraday volatility. If you have tried it on 0DTE, let me know how did it perform for you.

I'm an option trader and I'm loving this post!